11. February 2025

The Global Expansion of China’s Wind Power Leaders

Chinese onshore wind turbine OEMs are rapidly expanding their international footprint beyond their home market, reshaping the competitive landscape. Leading the charge are Envision, Goldwind and Sany.

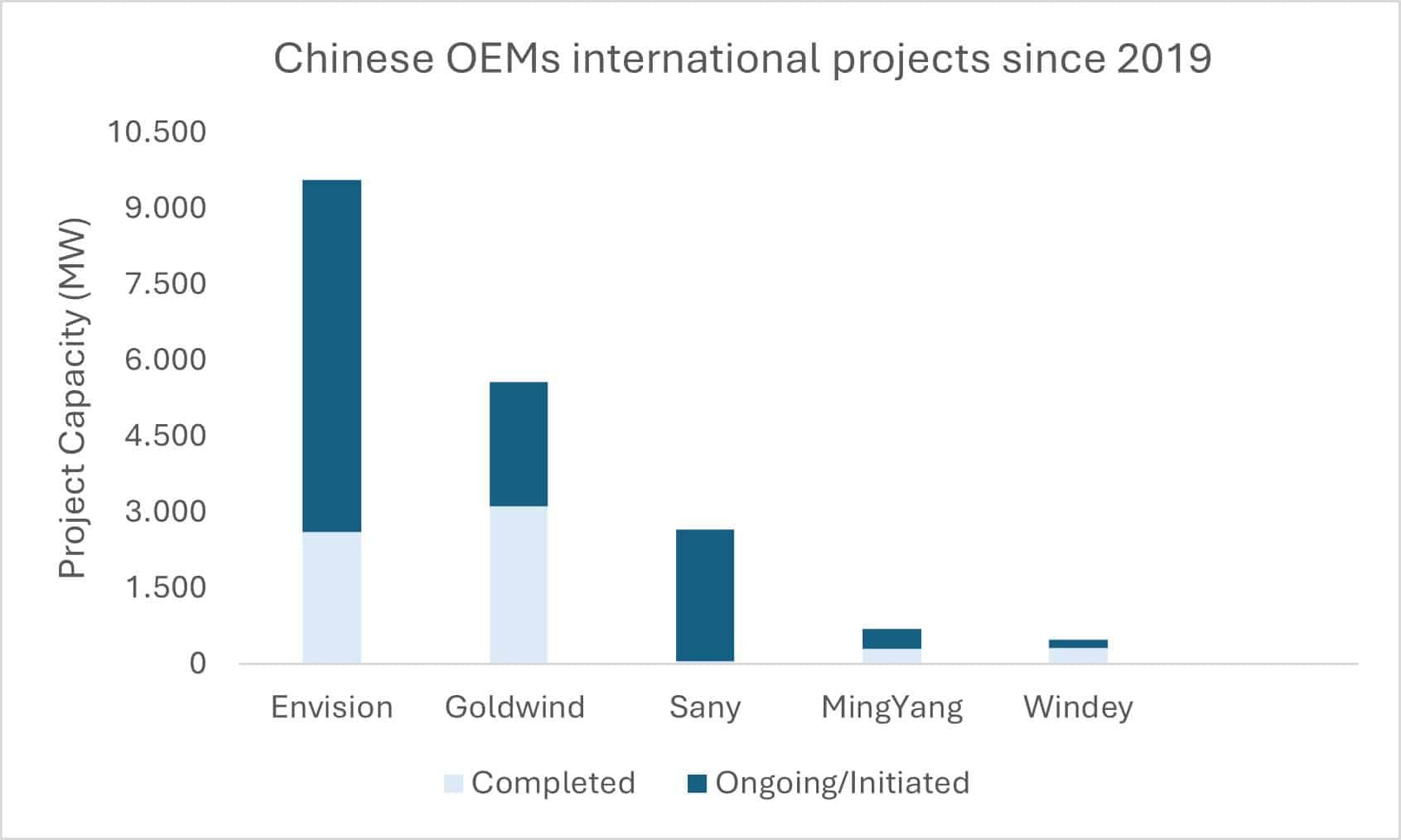

Over the past five years, Envision has dominated international onshore market expansion among its Chinese peers, securing 9.6 GW in total project capacity across completed and ongoing developments. Goldwind follows as the second-largest player with 5.6 GW.

While Goldwind has signed a greater number of project deals since 2019 – 27 compared to Envision’s 17 – Envision focuses on significantly larger projects. On average, its projects reach 562 MW, nearly three times the size of Goldwind’s 214 MW.

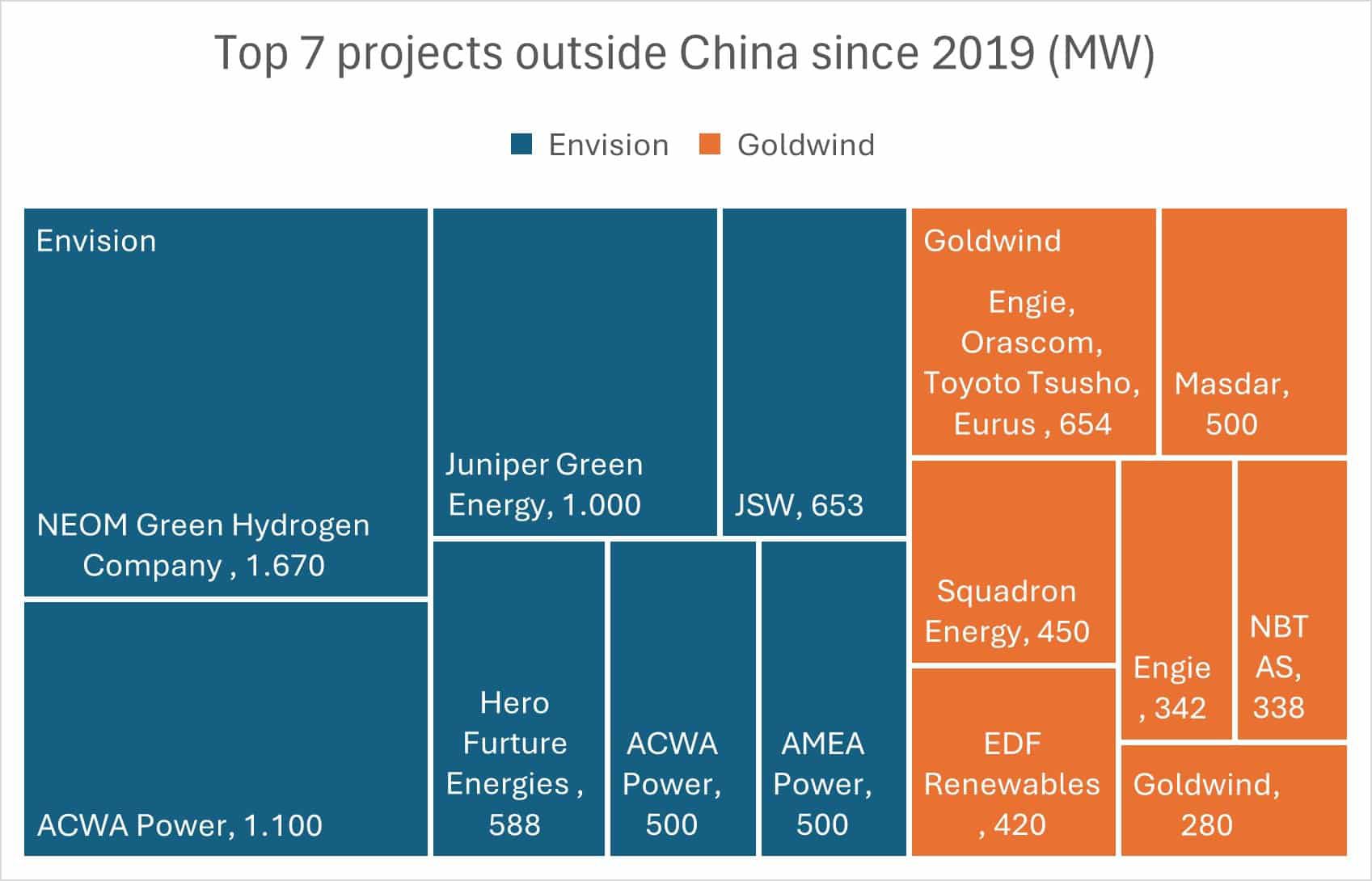

Envision focuses on large-scale projects with major developers and prominent investors in emerging markets such as India, Egypt, Uzbekistan, and the Philippines, prioritizing low LCOE.

In contrast, Goldwind strategically targets countries where China has established economic influence, including South America and Australia. By combining its expansion with infrastructure ownership and securing access to local resources such as mines, Goldwind strengthens its long-term positioning in these regions.

Envision has taken the lead in India, with 11 projects – five completed and six under development. Meanwhile, Goldwind has built a strong presence in Australia, securing 9 projects – six completed and three ongoing.

Further reinforcing their international expansion, Chinese OEMs have also embraced localization strategies. Goldwind established its first overseas factory in Brazil, while Envision is investing in wind turbine and energy storage manufacturing in Kazakhstan.

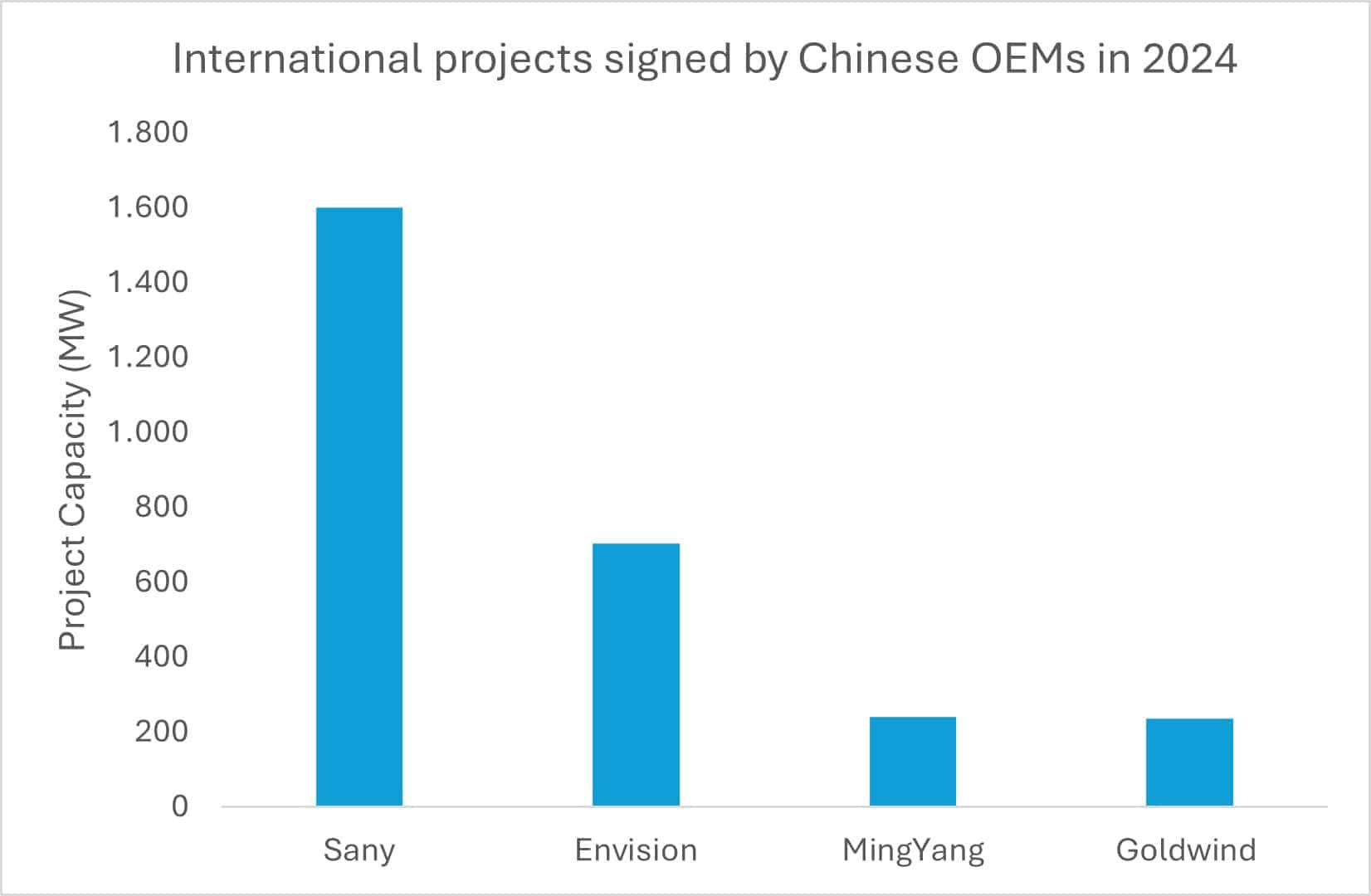

Sany is Advancing in International Expansion

In 2024, Sany secured the largest onshore international project among its competitors, signing a 1.6 GW deal in India with JSW and Sembcorp. This marks a strategic shift, as the company, previously focused on the domestic Chinese market, is now pursuing global expansion.

Furthermore, Sany is taking significant steps to establish a foothold in the European wind market through strategic initiatives. The company has begun construction on its first manufacturing facility outside China, located in Kazakhstan. This move will create a supply hub for the European market while mitigating potential trade restrictions and tariffs against China.

Sany is actively positioning itself for entry into the German market. It has launched two new onshore turbine models – the 7.8 MW SI-17578 and the 8.0 MW SI-18580 – both designed specifically for European wind conditions, presented at WindEurope in September 2024. Additionally, Sany has announced plans to begin European production by 2026, with Spain and Germany as potential locations. Rumors suggest Sany has already signed its first project in Germany with a well-known German developer.

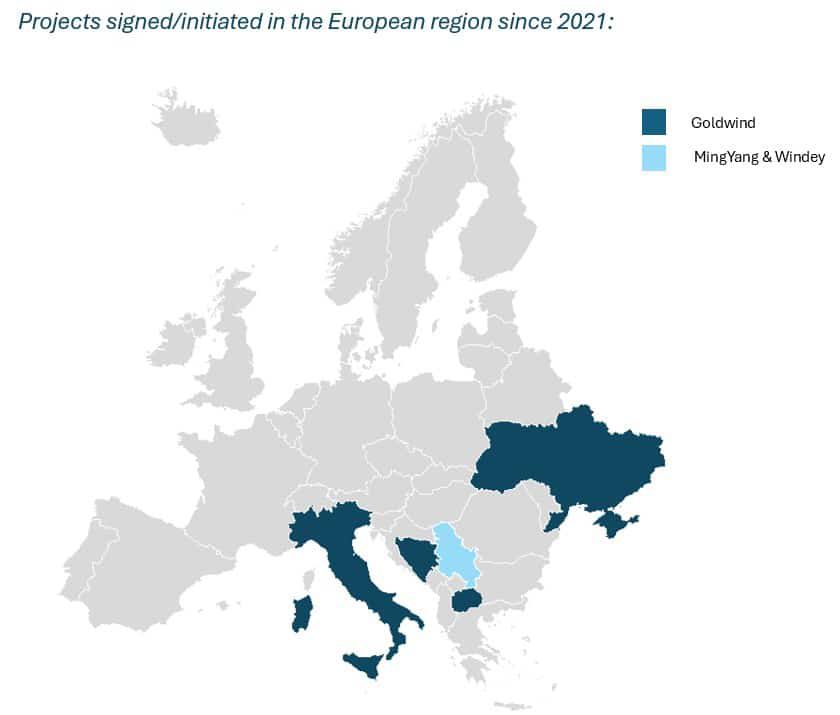

Chinese OEMs Are Expanding in the European Market

In addition to Sany, other Chinese OEMs are expanding into the European market. Goldwind leads the pack, having secured four projects across Italy, North Macedonia, Bosnia and Herzegovina, and Ukraine. Meanwhile, MingYang and Windey have also established their presence with projects in Serbia.

Moreover, Windey was selected as a preferred supplier for the 854 MW Maestrale Ring project in North Serbia by Fintel Energia.

Meanwhile, while Envision has yet to enter the European market, its new manufacturing facility in Kazakhstan suggests a potential long-term strategy for European expansion.