Power shift: Navigating the rise of Chinese wind turbine OEMs

22 April 2024

Chinese wind turbine OEMs have grown massively over the last 5 years. The top 5 OEMs have installed 59 GW of wind power in 2023, 4x the 2018 volume. In contrast, the Western top 5 grew by 1.6x only to around 38 GW. The staggering growth of Chinese players in absolute and relative figures sounds familiar in the renewables sector. 80-95% of the global PV module supply (depending on the manufacturing segment) comes from China and this is not expected to change despite political support for domestic production in the US and India.

From a European and US perspective the obvious concern is that the Western wind OEMs will be wiped out in the same way Western PV module manufacturers had experienced. Whilst there are similarities, we expect a different trajectory. Wind turbines are high-maintenance products that come as projects. PV modules, in contrast, are no-maintenance mass products.

China is extremely strong in manufacturing, but wind turbines come with additional challenges.

For many years, Chinese companies were the “workbench of the world”, mass-producing for Western companies. Their prices were, and are, highly attractive and made possible by low labor costs, low electricity prices, low raw material prices, and government support. Over time, Chinese companies have climbed up the value chain and further honed their skills in manufacturing competence which goes far beyond cheap labor and low electricity prices today. The huge domestic market and control over the whole upstream supply chain contributed to Chinese dominance. The end product, in this case, the PV module, is shipped in 40-foot containers to export markets.

However, selling a wind turbine requires significantly more interaction with the customer. The specific turbine type needs to be permitted for the specific project. Transport routes need to be clarified and permits need to be obtained. The turbine foundation must match the soil condition and interfaces to the tower supplier and local construction companies need to be managed. Wind turbines are big mechanical machines that do fail. The recent quality problems of Siemens Gamesa are the most prominent, but certainly not the only example of extremely expensive quality issues in wind. Developers, investors, and banks want to be assured of product quality and strong technical support over the project’s lifetime.

Chinese OEMs have been facing challenges entering international markets over the last few years.

In 2015, Envision tried to enter the European market but only installed a meager 42 turbines. Donfang is the same story with one wind farm in Sweden. Goldwind is active in Australia for many years. The projects they install are however own developments and not projects of 3rd party customers.

But things have changed: 16 Chinese OEMs are heavily competing in their home market to stay in the game, continuously strengthening their muscles in innovation, product development, and manufacturing excellence. As a result, the strongest penetrate the international markets and give the Western OEMs a hard time. Whilst Western OEMs keep prices high, cut back on markets, and pause on new product launches to return to profitability, the Chinese OEMs are doing the exact opposite.

Today, Chinese OEMs are leading the tech race and turbines are 20-40% cheaper compared to those of their Western peers.

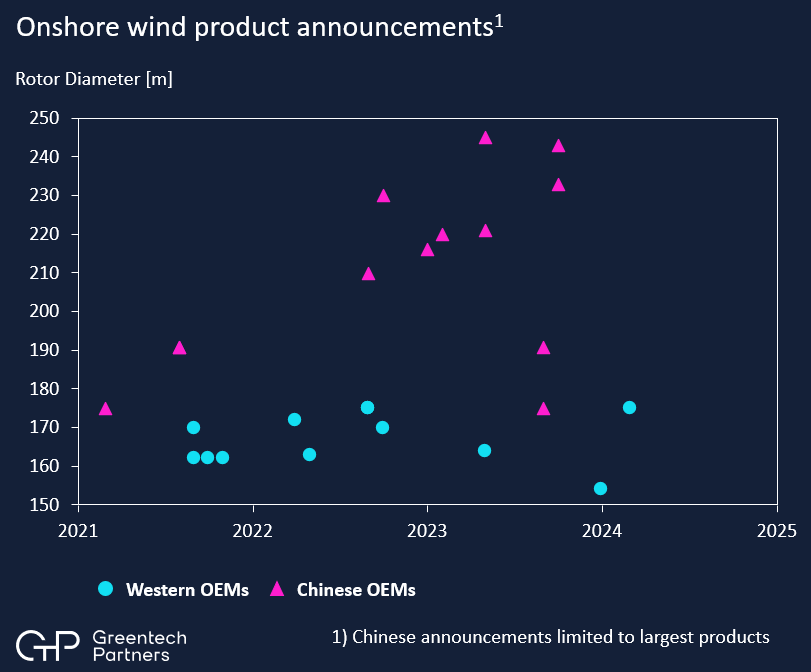

The products recently announced are around 40% bigger compared to the Western OEM’s flagship models. New product announcements of the Chinese OEMs come at a high pace and onshore wind turbines with rotor diameters beyond 240m and 12 MW rated power have been announced. The last larger onshore product introductions of the Western OEMs date back to 2022, when 175m rotor diameter machines were launched. It´s remarkable how aggressively Chinese OEMS launch new products and deploy them at scale.

In addition to the tech and cost advantages, Chinese OEMs are finding increasing answers to the “project business challenge” described earlier. International orders are rising in markets outside the EU and the US.

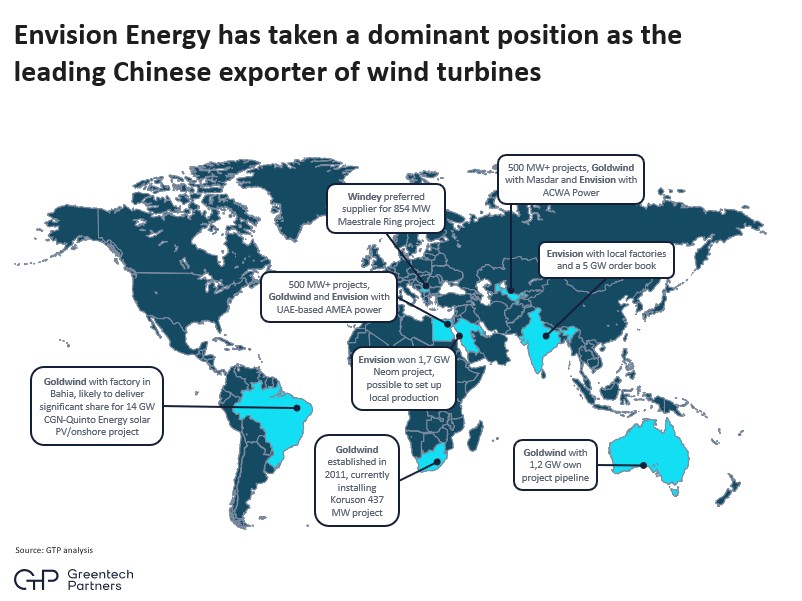

Chinese appetite to grow internationally is massive and a new dynamic is unfolding in international markets outside Europe and the US.

Envision is leading the pack with several 500 MW projects, a 5 GW pipeline in India, and the massive 1.67 GW NEOM project. Goldwind, also with big projects in the MENA region and Uzbekistan is due to open a factory in Brazil this year. Many of the large-scale projects are developed by Middle Eastern players like ACWA, Masdar, or AMEA. But also Western players like Engie, EDF, and CIP are building onshore wind farms with turbines from China.

Australia, Canada, and Eastern Europe (Windey is the preferred supplier for an 800 MW project in Serbia) are markets where Chinese players have won big projects and where they are likely to win even more going forward. Sany is very active in e.g. Germany but will have a hard time winning significant market shares in the EU.

Western OEMs do bag large deals in non-EU/non-US markets like Vestas (closed a 1.3 GW project in for Brazil in 2023) and GE Vernova (closed a 1.4 GW deal for Australia in 2024). But the air for them gets thinner in these markets, which is especially tough as the APAC and MEA markets are expected to outperform the EU and US in terms of growth.

So what’s next?

It´s a fact, that Chinese wind OEMs go international and do that very impressively outside Europe and the US. That narrows the international playground for Western OEMs which cannot compete for price reasons, and it happens at light speed. A power shift is underway and will impact all players in the wind sector:

- International project developers must take Chinese OEMs into account. If a decision is taken to buy Chinese turbines a whole new set of risks must be assessed.

- Turbine OEMs must make decisions about how to compete. The time of conservative product launches and high prices can be over as soon as the Chinese players gain shares in further markets.

- Suppliers need to find their position in Chinese OEMs and competitors.

- Investors need to understand the risks and opportunities arising from the power shift.

The basis for navigating the changing environment where Chinese OEMs will play an increasingly strong role outside China is understanding in depth of the Chinese OEMs.

- Who is leading these companies? Who are their shareholders? What are their figures?

- What are their footprints and manufacturing capacities?

- How competitive are their products?

- Which markets are they active in? What are their key customers?

- What are their North Star projects to prove their capabilities to developers, investors, and banks?

- How big and mature is their product pipeline?

- What is the potential impact of Chinese wind turbine OEMs’ rise on Western wind OEMs?

We answered these and other questions in a comprehensive study on the top 5 Chinese Wind Turbine OEMs.